Proposed Inflation Schedule

As mentioned above, the network's Inflation Schedule is uniquely described by three parameters: Initial Inflation Rate, Disinflation Rate and Long-term Inflation Rate. When considering these numbers, there are many factors to take into account:

- A large portion of the SOL issued via inflation will be distributed to stake-holders in proportion to the SOL they have staked. We want to ensure that the Inflation Schedule design results in reasonable Staking Yields for token holders who delegate SOL and for validation service providers (via commissions taken from Staking Yields).

- The primary driver of Staked Yield is the amount of SOL staked divided by the total amount of SOL (% of total SOL staked). Therefore the distribution and delegation of tokens across validators are important factors to understand when determining initial inflation parameters.

- Yield throttling is a current area of research that would impact staking-yields. This is not taken into consideration in the discussion here or the modeling below.

- Overall token issuance - i.e. what do we expect the Current Total Supply to be in 10 years, or 20 years?

- Long-term, steady-state inflation is an important consideration not only for sustainable support for the validator ecosystem and the Solana Foundation grant programs, but also should be tuned in consideration with expected token losses and burning over time.

- The rate at which we expect network usage to grow, as a consideration to the disinflationary rate. Over time, we plan for inflation to drop and expect that usage will grow.

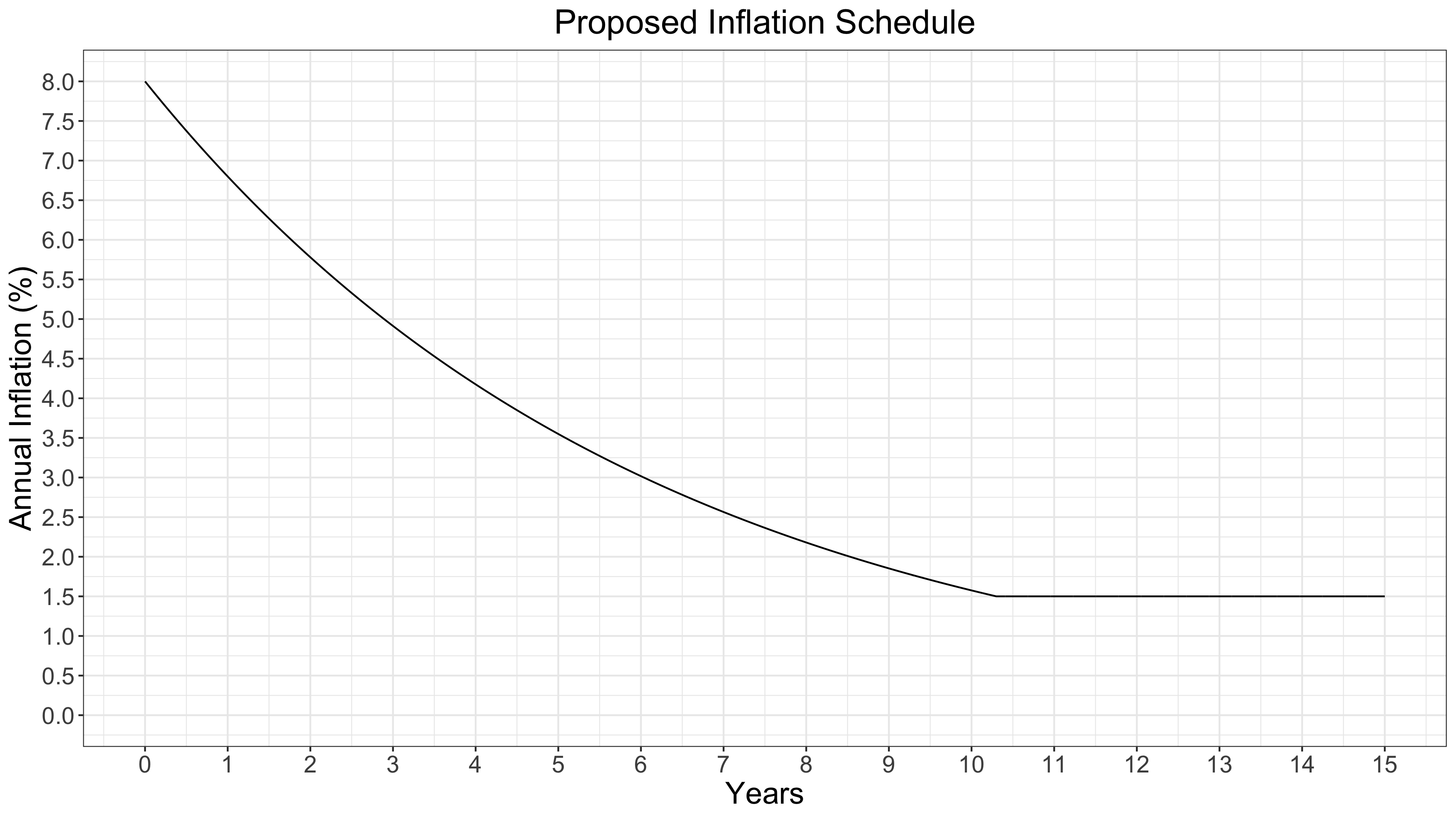

Based on these considerations and the community discussions following the initial design, the Solana Foundation proposes the following Inflation Schedule parameters:

- Initial Inflation Rate: 8%

- Disinflation Rate: -15%

- Long-term Inflation Rate: 1.5%

These parameters define the proposed Inflation Schedule. Below we show implications of these parameters. These plots only show the impact of inflation issuances given the Inflation Schedule as parameterized above. They do not account for other factors that may impact the Total Supply such as fee/rent burning, slashing or other unforeseen future token destruction events. Therefore, what is presented here is an upper limit on the amount of SOL issued via inflation.

Example proposed inflation schedule graph

Example proposed inflation schedule graph

In the above graph we see the annual inflation rate percentage over time, given the inflation parameters proposed above.

Example proposed total supply graph

Example proposed total supply graph

Similarly, here we see the Total Current Supply of SOL [MM] over time,

assuming an initial Total Current Supply of 488,587,349 SOL (i.e. for this

example, taking the Total Current Supply as of 2020-01-25 and simulating

inflation starting from that day).

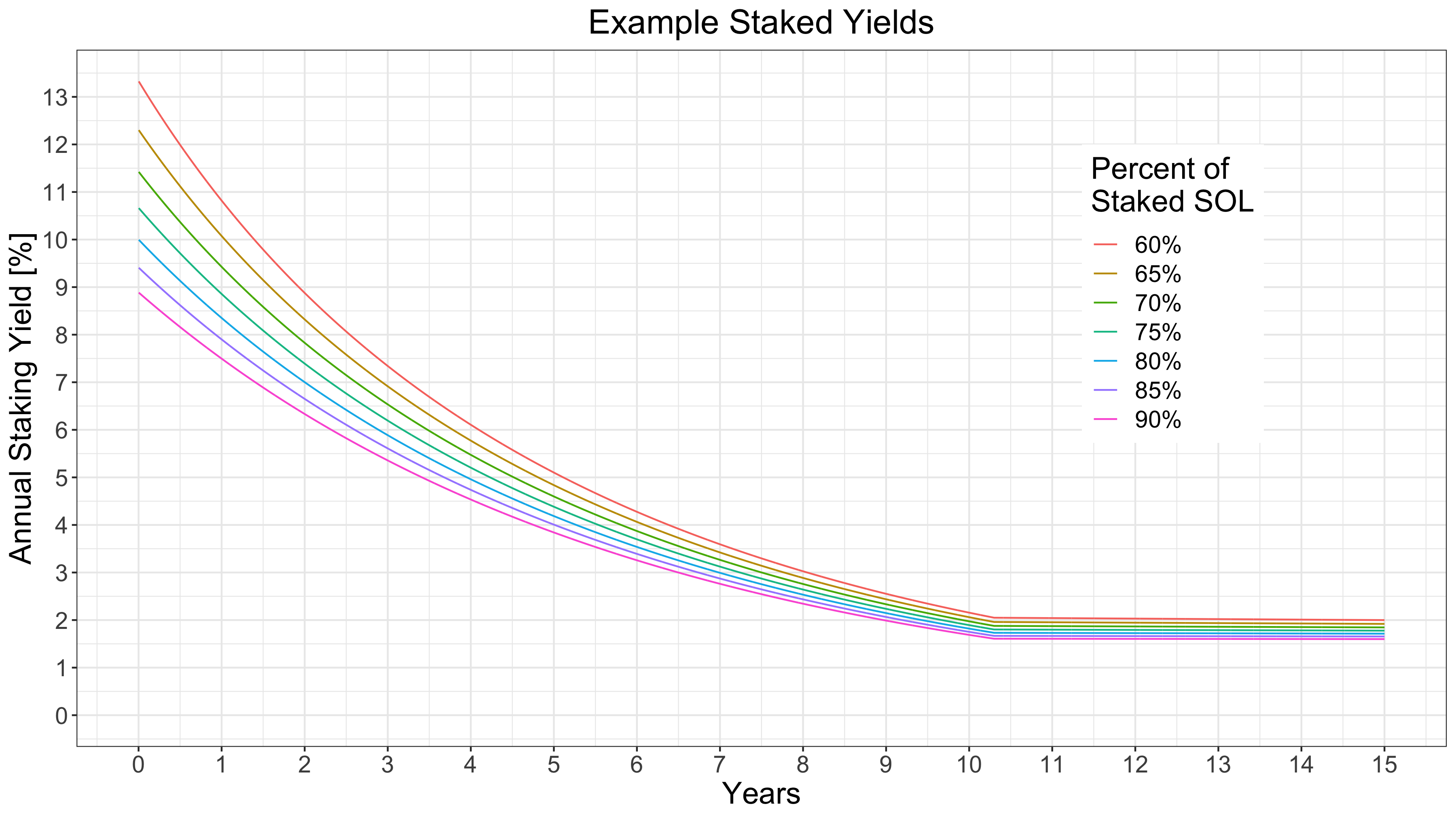

Setting aside validator uptime and commissions, the expected Staking Yield and Adjusted Staking Yield metrics are then primarily a function of the % of total SOL staked on the network. Therefore we can model Staking Yield, if we introduce an additional parameter % of Staked SOL:

This parameter must be estimated because it is a dynamic property of the token holders and staking incentives. The values of % of Staked SOL presented here range from 60% - 90%, which we feel covers the likely range we expect to observe, based on feedback from the investor and validator communities as well as what is observed on comparable Proof-of-Stake protocols.

Example staked yields graph

Example staked yields graph

Again, the above shows an example Staked Yield that a staker might expect over time on the Solana network with the Inflation Schedule as specified. This is an idealized Staked Yield as it neglects validator uptime impact on rewards, validator commissions, potential yield throttling and potential slashing incidents. It additionally ignores that % of Staked SOL is dynamic by design - the economic incentives set up by this Inflation Schedule are more clearly seen when Token Dilution is taken into account (see the Adjusted Staking Yield section below).